How does the OQR Penalty Work?

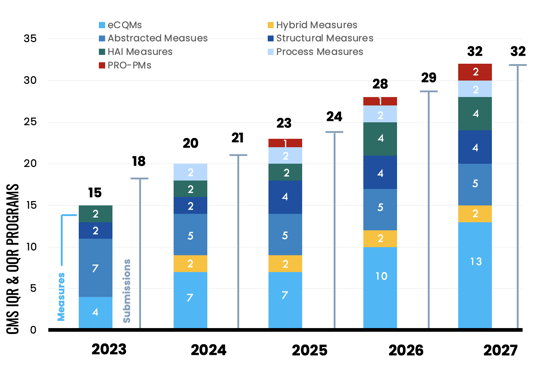

In the next few years, Quality leaders must report a slew of new required measures to the CMS Inpatient and Outpatient Quality Reporting (IQR & OQR) programs.

All of these measures are publicly reported and missing even one measure, one submission, one time will result in a failure to successfully meet your reporting requirements, which has long-reaching financial consequences. CMS penalizes hospitals that fail to meet their IQR and OQR requirements.

Phew! That’s a lot of pressure on a quality leader.

In this article, we focus on the Outpatient penalty only and explain the financial implications of not successfully meeting OQR program requirements.

Also see: How does the IQR Penalty Work?

If you need support with OQR reporting, check out Medisolv's offering for the Outpatient Quality Reporting Program.

The Penalties

Under the OQR program, hospitals that do not meet the requirements face a penalty of a 2% reduction to your Medicare claims reimbursement for certain outpatient department services.

The Math

To illustrate the financial impact, let's consider a hypothetical scenario:

A Medicare patient comes to your hospital for an emergency department visit for Acute Otitis Media (AOM) (an earache). That’s a low-level emergency department visit. Your hospital bills CMS using what’s called a Healthcare Common Procedure Coding System (HCPCS) code or a Current Procedural Terminology (CPT) code. In our earache example, a hospital would bill CMS using the CPT code 99281.

CMS has this concept called Relative Weight, which is the weight of each HCPCS or CPT code. The Relative Weight is multiplied by the Outpatient Department (OPD) fee (set by CMS). In 2024, this OPD fee is $87.382.

In our earache example, when you submit that claim, CMS will reimburse you for $87.382 X Relative Weight of the procedure. A low-level emergency department visit has a Relative Weight of 0.9680 – not quite 1.

$87.382 X 0.9680 = $84.59

So, your hospital will get paid $84.59 for that outpatient claim.

Now let’s say you fail to meet all your OQR reporting requirements. Instead of $87.382 you only get $85.687 (<< that’s your penalized reduced rate).

$85.687 X 0.9680 = $82.95

How the Penalty is Calculated

Hang on. If I reduce $87.382 by 2%, I come up with $85.634. You applied $85.687. That’s because there are a couple of steps CMS takes to assess the penalty.

Every year, CMS gives eligible hospitals a Market Basket Update (MBU) increase under the Outpatient Prospective Payment System (OPPS). You can think of it like a cost-of-living increase. It's the new payment rate CMS will pay your hospital for the costs you incur servicing their beneficiaries. They then assign a productivity adjustment, which gives you the final rate of increase you will receive if you meet all your OQR requirements.

If you don’t meet your OQR requirements, they take the 2% reduction off the 3.3% first, then they apply the productivity adjustment decrease.

|

Outpatient Hospital PPS |

Calendar Year 2024 |

|

Market Basket Update |

3.3 |

|

Productivity Adjustment |

-0.2 |

|

Market Basket Update less Productivity Adjustment |

3.1 |

So, a 3.1 MBU increase translates to $87.382. But a 2% penalty gives you a rate of $85.687. But there’s a simpler way to understand the calculation. CMS has a something called a reporting ratio of 0.9806 to account for the 2% penalty off the MBU.

$87.382 X 0.9806 = $85.687

Calculating your Payment Rates (Unadjusted and Adjusted)

There are about 6,000 of those HCPCS or CPT codes that are qualified services under the OPPS. I’ve created an Excel worksheet for you below and included only services with the following status indicators of J1, J2, P, Q1, Q2, Q3, R, S, T, V, U, which are eligible (3rd column).

In the 6th column is the unadjusted payment rate for each eligible service. If you meet your OQR requirements, you’ll get reimbursed at that rate. If you don’t meet your OQR requirements, you’ll get the penalized rate (9th column).

[Excel Workbook Download] OQR Penalty Calculator: OPPS Payment by HCPCS Code for CY 2024

Each of these payment rates represent your unadjusted payment rates. CMS will complete additional steps to provide you a wage-adjusted rate. Here are the steps CMS takes to wage adjust your payment rates. This scenario below is assuming a non-penalized rate.

- Take 60% of your unadjusted rate and use that to account for labor.

- $87.382 X 0.6 = $52.429

- Multiply that number by the wage index level that applies to your specific hospital. This is determined by your CBSA code.

- Let’s say your hospital is in CBSA 35644 in New York. The wage index is 1.3318.

- $52.429 X 1.3318= $69.825 (<<wage adjusted labor portion)

- Take the remaining 40% of your unadjusted payment rate and add it to your wage-adjusted rate.

- $87.382 X 0.4 = $34.953

- $69.825 + $34.953 = $104.778 (<<wage adjusted payment rate)

OQR Penalties in 2024: What’s at risk

Now, that’s a lot to process. If you just want to get a rough estimate of what’s at risk for your hospital, use the unadjusted payment rate. To calculate your risk, you need to gather your 2023 volumes for Medicare patients billed for these HCPCS and/or CPT codes. As I mentioned, each code has a different reimbursement amount.

Let’s take a look at an example of just 6 of these ~6,000 codes. This is an example from a real 180-bed hospital.

|

HCPCS /CPT Code |

Short Descriptor |

SI |

APC |

Relative Weight |

Unadjusted Payment Rate |

Input Your Estimated Volume (Medicare Claims) |

Estimated Full Reimbursement |

Penalized Unadjusted Payment Rate |

Estimated Reimbursement with Failure to Report OQR |

Lost Revenue |

|

99281 |

Emr dpt vst mayx req phy/qhp |

J2 |

5021 |

0.9680 |

$84.59 |

341 |

$28,845.19 |

$82.95 |

$28,284.25 |

$560.94 |

|

99282 |

Emergency dept visit sf mdm |

J2 |

5022 |

1.7833 |

$155.83 |

1,319 |

$205,539.77 |

$152.81 |

$201,550.62 |

$3,989.15 |

|

99283 |

Emergency dept visit low mdm |

J2 |

5023 |

3.1111 |

$271.85 |

5,514 |

$1,498,980.90 |

$266.58 |

$1,469,926.67 |

$29,054.23 |

|

99284 |

Emergency dept visit mod mdm |

J2 |

5024 |

4.8294 |

$422.00 |

6,853 |

$ 2,891,966.00 |

$413.82 |

$2,835,886.52 |

$56,079.48 |

|

99285 |

Emergency dept visit hi mdm |

J2 |

5025 |

7.0036 |

$611.99 |

10,748 |

$ 6,577,668.52 |

$600.12 |

$ 6,450,062.60 |

$127,605.92 |

|

99291 |

Critical care first hour |

J2 |

5041 |

9.6757 |

$845.48 |

5,349 |

$ 4,522,472.52 |

$829.08 |

$ 4,434,758.04 |

$ 87,714.48 |

So, 6 codes in and you’ve missed out on $305,004.

More bad news, when you calculate all applicable 2023 volumes, this 180-bed hospital would get a whopping $7 million dollar penalty if they had missed their OQR requirements in 2023.

Someone at your organization should be able to provide you with the 2023 volumes for each of the codes in one of these Excel worksheets. You’ll be able to see how much money your organization would lose if they failed to report even one measure to the OQR program. This is assuming you have similar volumes in 2024.

And remember, this is just your OQR requirements. There are a dozen-ish CMS programs that you could potentially be reporting to, and that CMS could further penalize your hospital.

CMS proposes a yearly Market Basket Update in the OPPS Proposed Rule (around July) and finalizes it in the OPPS Final Rule, which comes out around November each year. I’ve pulled out the historical MBU for the OPPS (OQR) and other CMS programs.

The financial impact of not meeting OQR program requirements can be significant for hospitals. The penalties imposed by CMS and compounding losses over time make it crucial for quality leaders to get the support they need to successfully meet their reporting requirements.

If you’re concerned about keeping on top of everything this year, consider reaching out to us. We complete your hospital’s submission to the IQR, OQR, IPFQR, and TJC ORYX® programs. You'll never miss a submission deadline.

We also provide ongoing education to help you understand the final rules and explain exactly what you need to do to be ready for the applicable reporting year.

Also read: 2024 OQR Requirements

Also read: 2024 IQR Requirements

Medisolv Can HelpAlong with award-winning software, each client receives a dedicated Clinical Quality Advisor that helps you with your technical and clinical needs. We consistently hear from our clients that the biggest differentiator between Medisolv and other vendors is the level of one-of-one support. Especially if you use an EHR vendor right now, you’ll notice a huge difference.

|

.png?width=352&name=2026%20Quality%20Reporting%20Deadlines%20Guide%20(1).png)

-1.png?width=352&name=Blogimage_2026%20OPPS%20Proposed%20Rule%20(1)-1.png)

.png?width=352&name=Implementing%20New%20eCQMs%20A%20Strategic%20Guide%20for%20Hospital%20Quality%20Directors%20(1).png)

.png?width=352&name=BlogImage_InformationTransferPRO-PM%20(1).png)

Comments